Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value tumbled 4% in October, breaking its seven-year ‘Uptober’ streak as ETF outflows, profit-taking, and macro jitters weighed in the marketplace.

An evaluation by Fortune confirmed it was Bitcoin’s fourth-worst October efficiency since 2013 and the worst previously seven years. That left BTC trailing the S&P 500 inventory index, which rose 2.3%.

The sell-off got here as greater than $550 million flowed out of main Bitcoin and Ethereum ETFs late within the month, with analysts saying profit-taking additionally performed a component as Bitcoin treasury corporations, together with Michael Saylor’s Technique, additionally slowed their BTC shopping for.

We simply skilled the primary crimson October in 7 years!

We additionally had an historic liquidation in October!

UPTOBER was a fraud, however MOONVEMBER??

imho;

if you happen to can, DCA extra!

if you happen to can’t, DO NOT panic promote your luggage for affordable!

In case you are out of $$ and you’re certain of your port,… pic.twitter.com/LH7aYTwQeY

— Blockchain Bob (@blockchainbob) October 31, 2025

Even a one-year commerce truce between US President Donald Trump and China’s Xi Jinping this previous week was not sufficient to push Bitcoin again into the inexperienced for the month.

Trump’s October 10 announcement that he would impose a further 100% tariff on China’s exports had triggered greater than $19 billion in liquidations in 24 hours, the most important ever within the crypto market.

One of many causes sentiment remained downbeat after the US-China commerce truce was a remark this week by Federal Reserve Chair Jerome Powell that one other rate of interest lower in December is much from sure.

$BTC Stillness Is the Sign

Value strikes much less, conviction strikes extra.

Trade provide hits cycle lows whereas long-term holders tighten grip liquidity’s thinning quietly.

ETFs preserve absorbing with out headlines, mining issue climbs, and volatility compresses.

This isn’t… pic.twitter.com/7ylx3uoCW7

— Senior 🛡🦇🔊 (@SeniorDeFi) October 31, 2025

Bitcoin On-Chain Indicators Present Resilience

Regardless of the drop in coin value, on-chain knowledge factors to ongoing power within the Bitcoin community. Trade reserves of Bitcoin hit all-time lows in October, dropping by over 200,000 BTC in only one month. This implies fewer cash are being held on exchanges the place they’ll simply be offered.

An indication that buyers are shifting cash to their wallets and could also be planning to carry for the long run.

The availability of BTC on buying and selling platforms is shrinking, making the coin extra scarce and doubtlessly setting the stage for a future rally. This sample of withdrawal is much like what occurred earlier than Bitcoin’s main run-up in 2020 and displays robust perception in Bitcoin’s long-term worth.

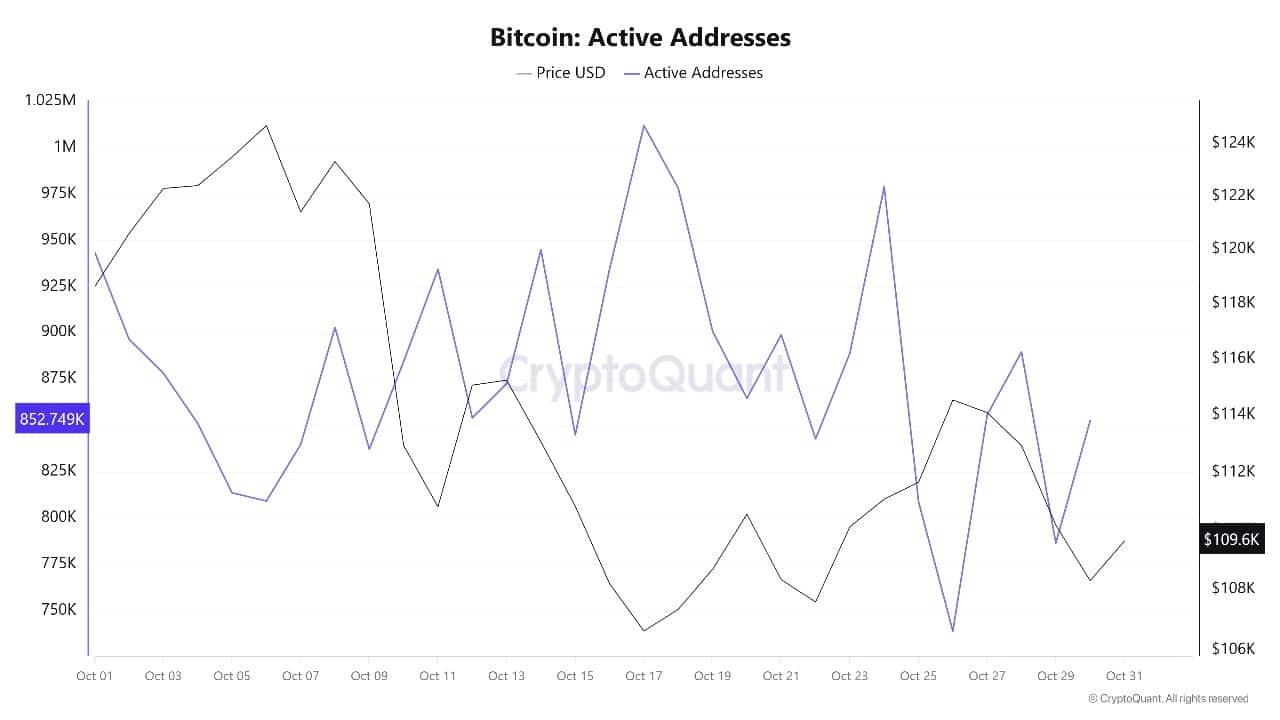

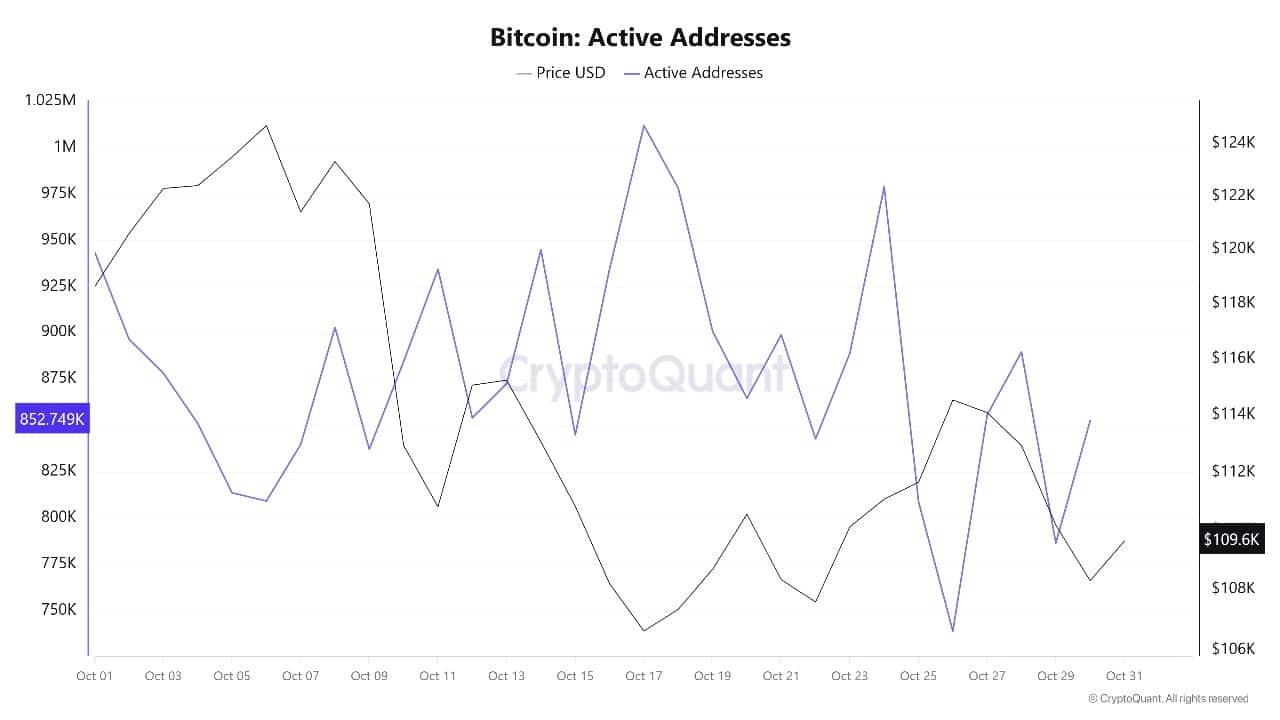

Institutional accumulation remains to be taking place even with ETF outflows, as some giant gamers switch cash into non-public custody. Bitcoin’s community exercise, together with energetic addresses and transaction counts, has remained strong, displaying individuals are utilizing the community even throughout a month of value declines.

Bitcoin Value Prediction

Wanting on the weekly value chart, Bitcoin is presently buying and selling at $109,496.77, after pulling again from the October excessive however staying effectively above necessary assist ranges. The value sits above the 50-week easy shifting common (SMA) at $102,843.54, whereas the long-term 200-week SMA is far decrease, at $54,756.36.

These SMA ranges act as robust assist for the Bitcoin value and assist restrict additional losses. The chart reveals Bitcoin is shifting inside an upward-trending channel, with resistance close to $125,761 and assist down round $102,843. The uptrend stays in play so long as the value holds above the decrease assist line and the important thing shifting averages.

Technical indicators level to a pause within the bullish momentum: The Relative Energy Index (RSI) is at 50.32, proper on the midpoint, suggesting neither patrons nor sellers are clearly in management and the market is consolidating.

BTCUSD Evaluation Supply: Tradingview

The Common Directional Index (ADX) reads 17.81, displaying the present development is weak, and new momentum is required to begin one other rally. If patrons return and push previous resistance at $125,761, Bitcoin may attempt to retake its highs. Nonetheless, if the value drops under the 50-week SMA ($102,843), additional promoting might push it towards the subsequent main assist at $54,756.

The MACD (Transferring Common Convergence Divergence) indicator stays in impartial territory, suggesting sideways motion for now. Low buying and selling quantity and an absence of robust momentum imply that Bitcoin might commerce in a decent vary over the approaching weeks.

If the coin value bounces from the $102,843 assist, a brand new try on the $125,761 resistance may carry in additional patrons. However a break under assist may even see Bitcoin take a look at deeper ranges earlier than bulls step in once more.

In November, a lot will rely on world monetary tendencies and whether or not new institutional cash returns to the market. If macro dangers settle and ETF flows change into optimistic once more, coin value may resume its climb and arrange for one more rally.

Nonetheless, value might consolidate, with bulls and bears ready for the subsequent huge transfer. Merchants ought to watch assist at $102,843 and resistance at $125,761, as breaks past these ranges may sign the subsequent route for Bitcoin’s value.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection