Bitcoin continues to wrestle beneath bearish stress following final Friday’s sharp market drop, with merchants nonetheless reeling from one of the vital risky weeks in months. Whereas BTC battles to carry above the $105K–$106K zone, gold has surged to new all-time highs, signaling rising uncertainty in international markets. This divergence between conventional secure havens and threat property has left buyers questioning what the macro sign really implies — whether or not it’s an indication of deeper financial fragility or a short lived rotation of capital.

Amid this cautious setting, an intriguing transfer by a well known whale has caught market consideration. The dealer — well-known for shorting each BTC and ETH throughout final week’s crash on Hyperliquid — is now flipping lengthy, opening large leveraged positions on the identical property he profited from shorting.

The whale’s actions have fueled hypothesis a couple of potential short-term rebound. Some analysts recommend this might mark the start of market maker accumulation, particularly as funding charges reset and liquidity normalizes. Nonetheless, with Bitcoin exhibiting technical weak spot and macro headwinds intensifying, merchants stay divided: is that this whale betting on an early reversal, or just getting ready for an additional volatility-driven shakeout earlier than the following main transfer?

Whale Doubles Down Regardless of Unrealized Loss

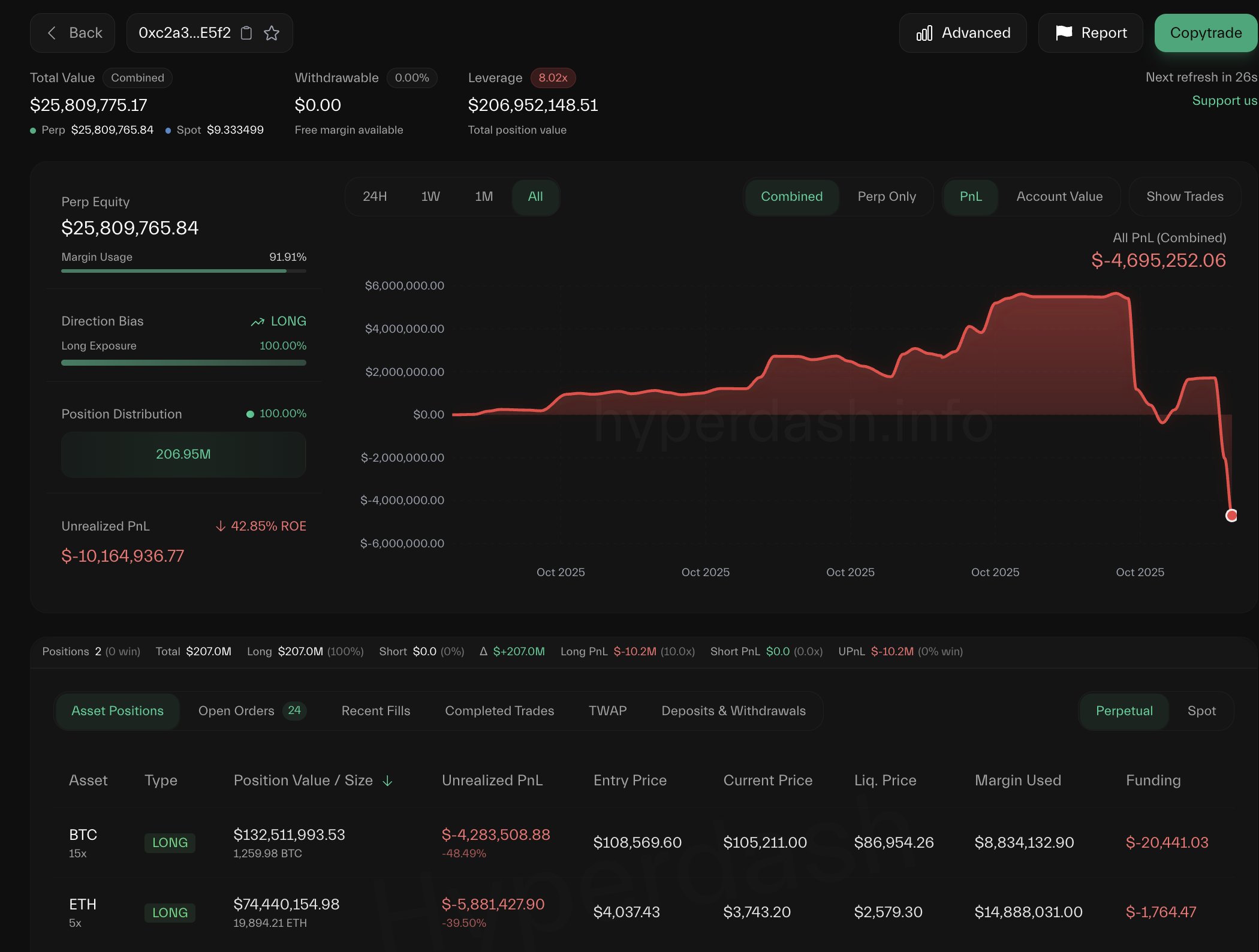

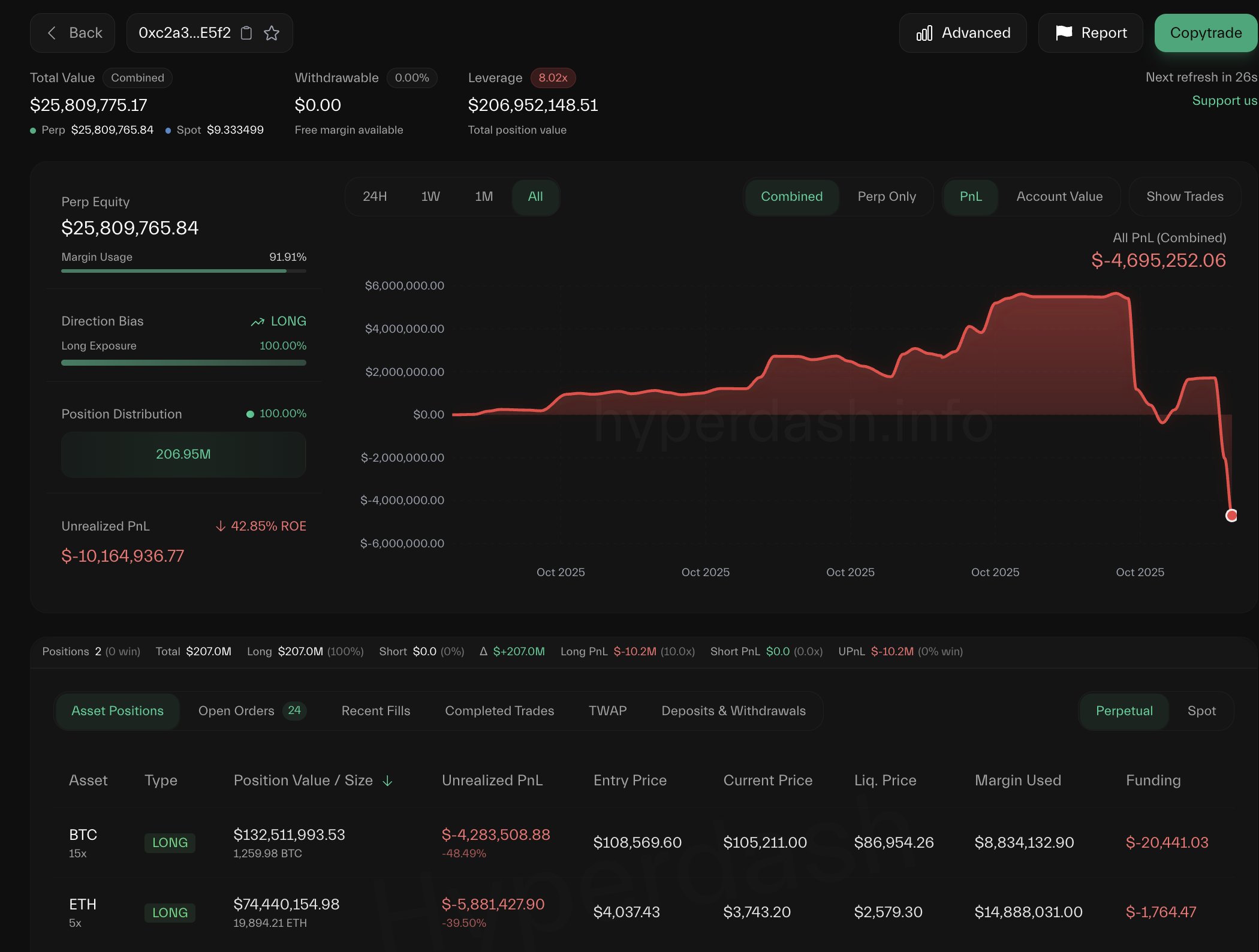

In line with Lookonchain insights, the well-known whale (0xc2a3) is now dealing with a dramatic reversal of fortune. After flipping his technique and opening large lengthy positions on each Bitcoin and Ethereum, the dealer has seen his earlier $5.5 million revenue fully erased, now sitting on a internet lack of $4.69 million. Regardless of this, on-chain knowledge exhibits he’s persevering with so as to add to his BTC longs, signaling a high-conviction — or high-risk — guess on an imminent market rebound.

At current, the whale’s positions quantity to 1,260 BTC (≈$132.5 million) and 19,894 ETH (≈$74.4 million). These are among the largest open positions on Hyperliquid, drawing intense scrutiny from merchants and analysts alike. Some speculate that his aggressive accumulation signifies insider confidence or a strategic long-term view, whereas others warn it could merely mirror overleveraged optimism amid deteriorating market construction.

In the meantime, Bitcoin’s worth continues to float towards vary lows, hovering simply above $105K, the place short-term holder realized costs and main shifting averages converge. The sustained promoting stress throughout exchanges and chronic bearish sentiment recommend that the market has but to discover a strong ground.

Nonetheless, the whale’s habits has launched renewed debate about whether or not sensible cash is positioning early forward of a restoration or misjudging a still-fragile market. If his conviction proves proper and BTC stabilizes, this might mark a key accumulation section earlier than the following leg up. But when not, the losses might deepen additional — reaffirming simply how risky and unpredictable Bitcoin’s macro panorama stays.

Bitcoin Faces Weekly Breakdown As Quantity Surges

Bitcoin’s weekly chart reveals a decisive shift in momentum, with worth closing close to $105,800 after a steep -8% decline for the week. The correction has erased a number of weeks of beneficial properties, pushing BTC dangerously near the 50-week shifting common (MA50), at present round $101,700 — a stage that has traditionally acted as a powerful assist throughout mid-cycle consolidations.

What stands out most on this chart is the sharp improve in buying and selling quantity, the best since late 2023, confirming that the most recent sell-off has been pushed by important market participation. The massive pink quantity bar signifies broad capitulation amongst short-term holders, aligning with on-chain knowledge exhibiting elevated realized losses and elevated promoting stress throughout exchanges.

If Bitcoin manages to carry above the $103K–$106K vary and defend the MA50, the construction might stay inside a broader bullish continuation sample. Nevertheless, a confirmed weekly shut beneath this assist would possible set off a deeper retracement towards $100K and even $97K, the place the 100-week MA at present lies.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Bitcoin continues to wrestle beneath bearish stress following final Friday’s sharp market drop, with merchants nonetheless reeling from one of the vital risky weeks in months. Whereas BTC battles to carry above the $105K–$106K zone, gold has surged to new all-time highs, signaling rising uncertainty in international markets. This divergence between conventional secure havens and threat property has left buyers questioning what the macro sign really implies — whether or not it’s an indication of deeper financial fragility or a short lived rotation of capital.

Amid this cautious setting, an intriguing transfer by a well known whale has caught market consideration. The dealer — well-known for shorting each BTC and ETH throughout final week’s crash on Hyperliquid — is now flipping lengthy, opening large leveraged positions on the identical property he profited from shorting.

The whale’s actions have fueled hypothesis a couple of potential short-term rebound. Some analysts recommend this might mark the start of market maker accumulation, particularly as funding charges reset and liquidity normalizes. Nonetheless, with Bitcoin exhibiting technical weak spot and macro headwinds intensifying, merchants stay divided: is that this whale betting on an early reversal, or just getting ready for an additional volatility-driven shakeout earlier than the following main transfer?

Whale Doubles Down Regardless of Unrealized Loss

In line with Lookonchain insights, the well-known whale (0xc2a3) is now dealing with a dramatic reversal of fortune. After flipping his technique and opening large lengthy positions on each Bitcoin and Ethereum, the dealer has seen his earlier $5.5 million revenue fully erased, now sitting on a internet lack of $4.69 million. Regardless of this, on-chain knowledge exhibits he’s persevering with so as to add to his BTC longs, signaling a high-conviction — or high-risk — guess on an imminent market rebound.

At current, the whale’s positions quantity to 1,260 BTC (≈$132.5 million) and 19,894 ETH (≈$74.4 million). These are among the largest open positions on Hyperliquid, drawing intense scrutiny from merchants and analysts alike. Some speculate that his aggressive accumulation signifies insider confidence or a strategic long-term view, whereas others warn it could merely mirror overleveraged optimism amid deteriorating market construction.

In the meantime, Bitcoin’s worth continues to float towards vary lows, hovering simply above $105K, the place short-term holder realized costs and main shifting averages converge. The sustained promoting stress throughout exchanges and chronic bearish sentiment recommend that the market has but to discover a strong ground.

Nonetheless, the whale’s habits has launched renewed debate about whether or not sensible cash is positioning early forward of a restoration or misjudging a still-fragile market. If his conviction proves proper and BTC stabilizes, this might mark a key accumulation section earlier than the following leg up. But when not, the losses might deepen additional — reaffirming simply how risky and unpredictable Bitcoin’s macro panorama stays.

Bitcoin Faces Weekly Breakdown As Quantity Surges

Bitcoin’s weekly chart reveals a decisive shift in momentum, with worth closing close to $105,800 after a steep -8% decline for the week. The correction has erased a number of weeks of beneficial properties, pushing BTC dangerously near the 50-week shifting common (MA50), at present round $101,700 — a stage that has traditionally acted as a powerful assist throughout mid-cycle consolidations.

What stands out most on this chart is the sharp improve in buying and selling quantity, the best since late 2023, confirming that the most recent sell-off has been pushed by important market participation. The massive pink quantity bar signifies broad capitulation amongst short-term holders, aligning with on-chain knowledge exhibiting elevated realized losses and elevated promoting stress throughout exchanges.

If Bitcoin manages to carry above the $103K–$106K vary and defend the MA50, the construction might stay inside a broader bullish continuation sample. Nevertheless, a confirmed weekly shut beneath this assist would possible set off a deeper retracement towards $100K and even $97K, the place the 100-week MA at present lies.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.