Bitcoin traded simply above $121,000 on Wednesday, holding onto features after a drop from a current peak above $126,000. In line with analyst Egrag Crypto, a small market transfer might set off a a lot bigger rally, constructing on a sample he says has repeated throughout previous cycles.

Associated Studying

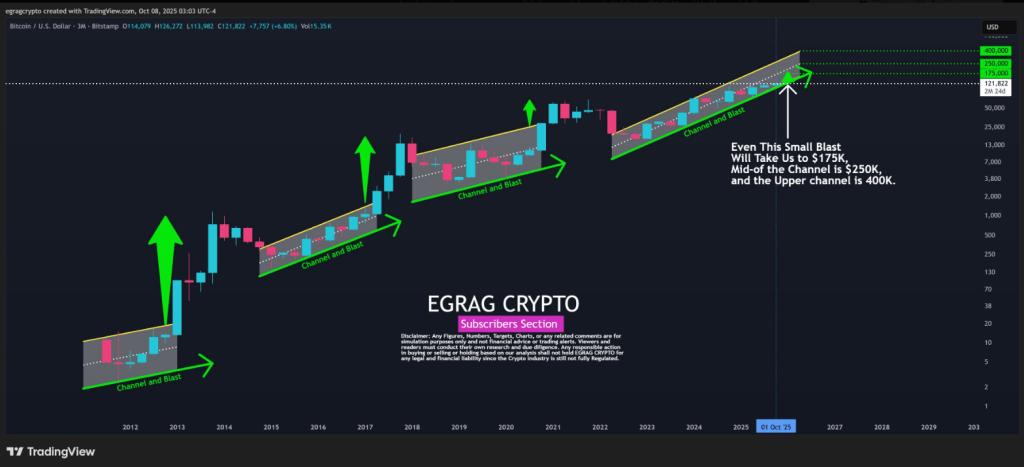

Historic Channel Breakouts

Egrag’s view is predicated on a three-month have a look at value channels that, he argues, have preceded main rallies. Based mostly on stories, related channel breakouts have been seen earlier than the 2013 surge to about $1,163, the 2017 rise previous $19,000, and the 2020–2021 rally that pushed costs above $69,000.

He says the present channel started forming in April 2022, and {that a} modest “blip” upward might push Bitcoin to $175,000. That focus on would require roughly an almost 43% rise from $122,620. Brief-term swings have ranged from $115,000 to $125,000 this week, whereas the current value sits close to $121,900.

#BTC – $175K Is Only a Blip:

If we have a look at the historic conduct of #BTC on a 3-month timeframe, we are able to see a transparent channel formation. Prior to now three cycles, we’ve persistently seen a breakout on the finish of those channels. Whereas diminishing returns are evident, they’re… pic.twitter.com/TabFoVlXBT

— EGRAG CRYPTO (@egragcrypto) October 8, 2025

Targets And Dangers To Watch

Egrag outlined a spread of doable outcomes. He positioned $175,000 as his main goal. He additionally recommended a midpoint close to $250,000 and an higher situation round $400,000. These are formidable numbers. They’re introduced as a part of a longer-term view relatively than guarantees of a right away transfer.

The analyst in contrast his Bitcoin name to a previous gold forecast—he set a $3,500 goal for gold that later noticed costs close to $4,000—utilizing that as a reference for his forecasting strategy.

On the identical time, on-chain knowledge supply a blended image. Blockchain analytics agency Glassnode reported that 97% of Bitcoin’s provide is now in revenue following the current rally.

That prime degree of realized revenue suggests many holders sit above their buy value. Some analysts interpret elevated revenue as an indication that markets could pause so traders can take features.

Associated Studying

Others level to crowded positions and rising leverage as indicators that short-term volatility might enhance. Reviews have disclosed concern about what some name a “Suckers Rally,” a spike that tempts late consumers and is adopted by a drop.

Market Conduct And Investor Strikes

Accumulation has been seen in lots of wallets. Some traders reallocated features relatively than promoting out fully, which, in response to stories, can point out a managed rotation of capital relatively than a panic sell-off.

Featured picture from Pixabay, chart from TradingView